Introduction to Calculate Import Tariffs

Ever wondered why that overseas shipment suddenly costs more than expected, or why a container gets stuck at customs? If you’ve ever imported goods, you’ve likely encountered import tariffs—taxes imposed by governments on products crossing their borders. But what exactly are these tariffs, and why is it so important to calculate them correctly?

Import tariffs, also known as import duties, are taxes charged on the value of goods brought into a country. These aren’t just arbitrary fees; they’re a fundamental part of international trade, influencing everything from the price tag on your product to your company’s bottom line. While tariffs can be used to protect local industries or generate government revenue, for importers, they’re a crucial variable that can make or break profitability.

Why You Need to Calculate Import Tariffs Accurately

Imagine planning a shipment, only to find out at customs that you owe far more in taxes and duties than anticipated. Sounds stressful, right? Inaccurate import duty calculation can lead to:

- Unexpected costs that eat into your margins or disrupt your pricing strategy

- Delays in customs clearance, as authorities may hold shipments for reassessment or additional documentation

- Financial penalties or fines for underpayment, misclassification, or incomplete declarations

- Poor budgeting for landed costs, making it hard to forecast true expenses or quote customers accurately

For example, if you’re importing $10,000 worth of electronics with a 10% tariff, that’s an extra $1,000 to account for—plus, possibly, value-added taxes or other local fees. Miss that calculation, and your profit margin could disappear overnight (source).

Breaking Down the Complexity

At first glance, learning how to calculate import tariffs can seem daunting. There are different types of tariffs, product codes, valuation rules, and country-specific regulations. But here’s the good news: the process can be broken down into clear, manageable steps. Whether you’re a business importing large shipments or an individual making an overseas purchase, you don’t need to be a trade expert to get it right.

Throughout this guide, we’ll walk you through the essential elements of import duty calculation—from understanding the key components to finding your product’s correct classification and applying the right formula. With practical examples and actionable tips, you’ll gain the confidence to handle import tariffs and avoid costly surprises.

Ready to demystify import tariffs and take control of your international trade costs? Let’s dive into the core components you need to master for accurate import duty calculation.

What Are the Key Components for Calculating Import Tariffs?

When you try to calculate import tariffs, it can feel like you’re piecing together a puzzle. Why do some shipments sail through customs while others hit unexpected snags or extra fees? The answer usually lies in how well you understand—and document—the core components of import duty calculation. Let’s break down these essential import tariff components so you can approach every shipment with confidence and clarity.

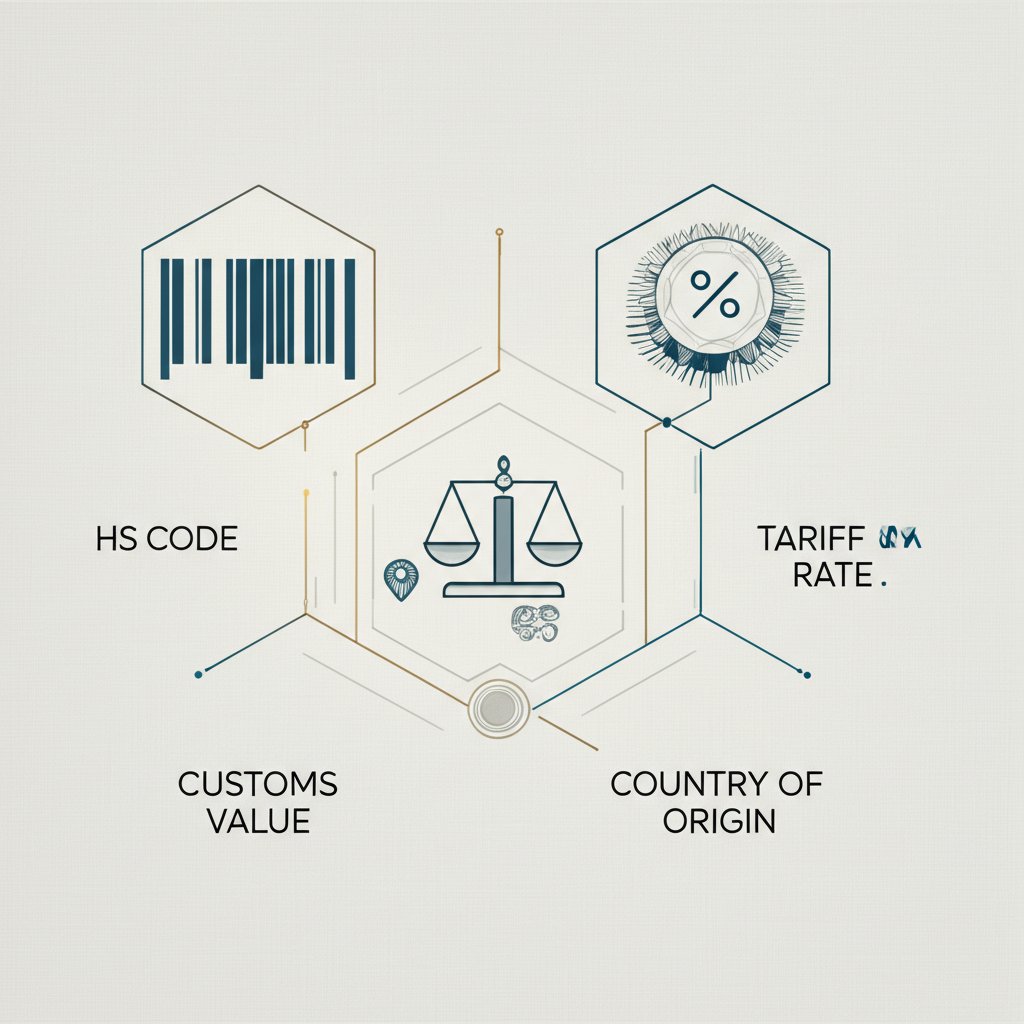

The Four Pillars of Import Duty Calculation

Every successful import tariff calculation relies on four main elements. Think of them as the foundation for ensuring you pay the correct amount—and avoid costly mistakes:

- Harmonized System (HS) Code

- Customs Value

- Country of Origin

- Applicable Tariff Rate

Let’s explore what each means and how they influence the final duty you’ll pay.

1. Harmonized System (HS) Code

The HS code is an internationally standardized product classification system. Every product you import is assigned a specific code based on its nature, use, and material. Customs authorities use this code to determine which tariff rates and trade rules apply to your shipment. If you misclassify your item, you could end up paying too much—or too little—in duties, which may trigger audits or fines (source).

2. Customs Value

Customs value isn’t just the price you paid for the goods. It often includes freight, insurance, and sometimes other costs like commissions or packing. This value forms the base for calculating the duty amount. If you understate the customs value, you risk penalties; if you overstate it, you’ll pay more than necessary (source).

3. Country of Origin

Where your goods are made matters. The country of origin can affect which tariff rate applies, especially if your country has a free trade agreement with the exporting nation. Sometimes, the country of origin isn’t where the goods are shipped from, but where they were substantially transformed or manufactured (source).

4. Applicable Tariff Rate

This is the actual percentage or amount charged on your goods. The tariff rate is determined by the combination of your product’s HS code and country of origin. Some products have preferential rates due to trade agreements, while others are subject to standard (Most Favored Nation) rates. Tariff rates can change, so using up-to-date information is crucial.

Why Each Component Matters

- HS Code: Directly impacts which rules and rates apply.

- Customs Value: Sets the base for duty calculation—errors here multiply downstream costs.

- Country of Origin: Determines eligibility for reduced or zero tariffs under trade agreements.

- Tariff Rate: The final multiplier—if you get the first three right, this gives you the precise duty owed.

Imagine importing electronics with the wrong HS code or missing a preferential tariff from a trade agreement—your costs could spike, or your shipment could be delayed for reassessment. That’s why each step in the process is critical for those who want to accurately calculate import duty and avoid unpleasant surprises.

Now that you know the building blocks, let’s move on to the first—and arguably most important—step: finding your product’s correct HS code.

A Step-by-Step Guide to Finding Your Product’s HS Code

Ever wondered why two similar shipments can face wildly different import duties? The answer often lies in a single number: the Harmonized System (HS) code. If you want to accurately calculate import tariffs, mastering the HS code lookup process is your first—and most crucial—step. Let’s break down what HS codes are, how they work, and how you can confidently assign the right one to your product.

What Is an HS Code and Why Does It Matter?

HS codes are standardized numerical identifiers used worldwide to classify traded goods. Developed by the World Customs Organization, the system ensures every product has a unique code based on its material, function, and use. Think of the HS code as a universal language for customs authorities: it tells them exactly what’s in your shipment, which rules apply, and how much duty you’ll owe.

Each HS code consists of at least six digits, structured as follows:

- First 2 digits: Chapter (broad product category)

- Next 2 digits: Heading (more specific grouping)

- Last 2 digits: Subheading (detailed description)

Many countries expand on these six digits for even finer classification, but the first six remain the same globally. For example, the U.S. uses a 10-digit code for imports, but the first six always match the international HS code.

Why Getting the HS Code Right Is Critical

Assigning the wrong HS code isn’t just a minor paperwork error—it can have serious consequences. If you misclassify your product, you might:

- Overpay duties by assigning a code with a higher tariff rate than necessary

- Underpay and risk penalties if customs discovers a lower duty was applied

- Face shipment delays or even seizure at the border

- Lose out on trade agreement benefits if the code excludes your product from preferential rates

Imagine importing a car seat under an automotive parts code, only for customs to reclassify it as furniture—your costs and compliance obligations could change overnight. That’s why an accurate HS code for import duty calculation is non-negotiable.

How to Perform an Effective HS Code Lookup

Sounds complex? Here’s a straightforward process to help you find the correct code every time:

- Gather detailed product information: Start with technical data sheets, bill of materials, application, chemical composition, packaging details, and any relevant certifications or restrictions. The more precise your description, the better your chances of accurate classification (source).

- Check official customs resources: Use your country’s HS code classification website or databases like the U.S. Census Bureau’s Schedule B search tool or CROSS for imports. These tools allow you to search by product name, material, or use and provide guidance on the correct code (source).

- Compare with competitor products: If your product is similar to those already on the market, look up how competitors classify theirs—especially if they share the same materials and applications. This can help narrow your options.

- Apply the General Rules of Interpretation (GRI): These six rules guide you through ambiguous cases. Start with the most specific heading and use the notes in each section or chapter to ensure the closest match. If in doubt, Rule 6 lets you choose the subheading that most closely resembles your product’s essential characteristics.

- Document your classification process: Keep records of how you arrived at your chosen HS code, including references to headings, notes, and any expert advice.

- Seek Binding Tariff Information (BTI): For added certainty, request a BTI from your customs authority. This legally binds customs to your chosen code for future shipments, minimizing disputes (source).

Best Practices and Pro Tips

- Update regularly: HS codes and tariff schedules are updated every five years. Always check the latest version before shipping.

- Consult experts if unsure: Customs agents or trade consultants can help with tricky classifications and ensure compliance.

- Be wary of supplier codes: Codes provided by foreign suppliers may not align with your country’s specific extensions—always verify locally.

“Accurate HS code classification is the single most important step in import duty calculation. Get this right, and you set the stage for smooth customs clearance and cost control.”

Ready to move forward? With your product’s HS code in hand, you’re now prepared to tackle the next essential component: determining the customs value of your goods—a key factor in calculating your total import duty.

How to Accurately Determine the Customs Value of Your Goods

When you see the term “customs value,” do you immediately think of your invoice price? If so, you’re not alone—but here’s the catch: customs value calculation is rarely that simple. Imagine paying import duties on a shipment, only to find out later that insurance or freight charges should have been included, or that customs authorities question your declared value. Sounds complicated? Let’s break it down in plain English, so you can approach every shipment with confidence and avoid costly surprises.

What Is Customs Value—and Why Does It Matter?

Customs value is the total amount customs authorities use as the basis for calculating your import duties and taxes. It’s more than just what you paid for the goods; it often includes additional costs that bring the goods to your border. Getting this number right is critical, because under-declaring or over-declaring can lead to penalties, shipment delays, or paying more than necessary (source).

The Transaction Value Method: The Gold Standard

The most common method for customs value calculation is the transaction value for import. This is essentially the price you actually paid or will pay for the goods when sold for export to your country. However, this method is only valid if certain conditions are met—like having a legitimate sale, no hidden restrictions, and unrelated parties, or proving that the relationship didn’t affect the price (source).

But here’s where many importers slip up: the transaction value often requires adjustments. Customs authorities expect you to add in costs that directly relate to getting the goods to your country. Missing these can trigger questions or extra fees.

What’s Included in Customs Value? (It’s More Than You Think!)

When using the transaction value for import, make sure to include:

- Product cost: The actual price paid for the goods

- Freight charges: Shipping costs to the port or place of importation

- Insurance: Protection for goods during transit

- Packing and container costs: Materials and labor for preparing goods for shipment

- Commissions and brokerage (excluding buying commissions): Fees paid to agents or brokers for facilitating the sale

- Assists: The value of materials, components, or services provided by the buyer free or at reduced cost (like molds, tools, or design work used in production)

- Royalties and license fees: Payments the buyer must make as a condition of the sale

- Proceeds from resale: Any part of the resale proceeds that go back to the seller

Think of it this way: customs wants to know the full landed value of the goods at your border, not just the price on your supplier’s invoice. For example, if you bought $10,000 worth of electronics, paid $1,000 for shipping, and $200 for insurance, your customs value would be $11,200—not just $10,000.

Alternative Customs Valuation Methods

What if the transaction value can’t be used—maybe because there’s no sale, or the relationship between buyer and seller affects the price? Customs authorities have a step-by-step backup plan, moving through these alternative methods:

- Transaction value of identical goods: Based on the price of identical goods imported at the same time

- Transaction value of similar goods: Uses the price of similar (but not identical) items

- Deductive value method: Starts with the resale price in the importing country, minus certain costs and profit margins

- Computed value method: Adds up production costs, profits, and expenses from the country of export

- Fallback method: Applies reasonable means consistent with global customs valuation principles

Customs will only move to these methods if the transaction value method is clearly inapplicable or insufficiently documented. Most importers will use the transaction value, but knowing the alternatives protects you if questions arise.

Why Third-Party Verification Matters

Ever had customs question whether your declared value matches what’s actually in the box? This is where third-party verification becomes a game changer. Customs authorities have the right to request supporting documents or even inspect goods to confirm the declared value. If discrepancies are found, you could face reassessment or fines (source).

That’s why many savvy importers use independent inspection services to verify shipment details before they even leave the exporting country. For example, a pre-shipment inspection checks that the goods match your order in quantity, quality, and specifications—providing clear evidence that your declared customs value is accurate and defensible.

Protecting Your Customs Value with Eagle Eyes Quality Inspection Services

Imagine investing thousands in import tariffs, only to discover your goods are defective, miscounted, or not as described. Not only do you lose money on the products—you’ve also paid non-refundable taxes on them. Eagle Eyes Quality Inspection Services steps in as your on-the-ground partner in China, offering pre-shipment inspections, factory audits, and container loading supervision. Their extensive coverage ensures you can verify any shipment, anywhere in China, before it leaves the factory.

With Eagle Eyes, you gain:

- Accurate documentation for your customs value calculation

- Evidence to support your declared value if customs authorities raise questions

- Peace of mind that your import tariffs are based on viable, sellable inventory—not on defective or incorrect goods

In short, third-party verification isn’t just about compliance—it’s a smart way to safeguard your landed cost and ensure your customs value calculation is always correct. Now that you know how customs value is determined, let’s explore how the country of origin can further impact your tariff rates and eligibility for exemptions.

Why the Country of Origin is Crucial for Tariff Calculation

When you’re ready to calculate import tariffs, have you ever wondered why customs always ask for the country of origin—not just the country you’re shipping from? The answer isn’t always obvious, but understanding country of origin rules is essential for avoiding costly mistakes and unlocking potential savings through preferential tariff rates. Let’s unpack why COO matters so much and how it can shape your entire import strategy.

Country of Origin vs. Country of Shipment: What’s the Difference?

Imagine you’re importing electronics from Germany, but the products were actually manufactured in Vietnam. Even if the shipment leaves from a German port, customs authorities will focus on where the goods were made, not where they were sent from. This distinction is critical because the tariff rates by country depend on the true origin—not the shipping point.

- Country of Origin (COO): Where the goods were produced, manufactured, or substantially transformed.

- Country of Shipment: The last country from which the goods were shipped before entering your market.

Why does this matter? Because many countries have trade agreements or restrictions that apply only to goods from specific origins. Getting this wrong could mean missing out on duty-free treatment or, worse, paying higher tariffs than necessary.

How COO Impacts Tariff Rates and Trade Agreements

Once you know your product’s HS code and customs value, the next step is to check if your country has a free trade agreement (FTA) or preferential trade arrangement with the country of origin. If so, you might qualify for reduced or even zero tariffs. Here’s how COO influences your duty calculation:

- Preferential Rates: Products originating from FTA partner countries often enjoy lower or zero tariffs. For example, U.S.-made goods shipped to a U.S. FTA partner can enter duty-free if they meet the specific rules of origin for that agreement (source).

- Most Favored Nation (MFN) Rates: If there’s no FTA, the standard MFN tariff applies. These rates can be significantly higher than preferential rates.

- Trade Restrictions: Some products from certain countries may face additional duties, quotas, or outright bans.

So, the right COO can mean the difference between a 0% and a 20% duty rate—or even determine if your goods can be imported at all.

Decoding Country of Origin Rules: The Role of Substantial Transformation

But what if your product is assembled from parts made in multiple countries? Here’s where the concept of substantial transformation comes into play. Customs authorities use this principle to decide which country gets credit as the origin:

- Wholly Obtained: If a product is grown, mined, or manufactured entirely in one country, that country is the COO.

- Substantial Transformation: For goods made from components sourced from different countries, the COO is the country where the product underwent a fundamental change in form, function, or character—usually through manufacturing or processing (source).

For example, if bicycle parts from Taiwan are assembled into a finished bike in Mexico, and the assembly process changes the components into a new commercial product, Mexico becomes the country of origin—even if some parts were imported.

| Scenario | Resulting Country of Origin |

|---|---|

| All components produced and assembled in one country | That country |

| Components from several countries, assembled in a new country (substantial transformation) | Country where transformation occurs |

| Simple packaging or minor assembly in a different country | Original country of main components |

Proving and Documenting COO: Why It Matters

To benefit from preferential tariff rates, you’ll need to provide proof of origin—often in the form of a certificate of origin or supporting documentation. Customs authorities may scrutinize your claim, especially if your product includes global components. If you can’t prove COO, you risk losing eligibility for reduced tariffs or even facing penalties.

In summary, understanding and correctly documenting the country of origin is a cornerstone of accurate import duty calculation. It determines your eligibility for trade agreements, affects your bottom line, and ensures compliance with global trade rules. Next, let’s see how all these elements—HS code, customs value, and COO—come together in the core formula for calculating your import tariff.

The Core Formula for Calculating Your Import Tariff

Ever stared at a pile of shipping documents and wondered, “How do I actually calculate customs duty for this shipment?” If so, you’re not alone. Many importers find the process daunting until they realize that—at its heart—the import duty formula is refreshingly simple. Let’s walk through this core calculation, break down each element, and see how you can avoid costly errors by getting every detail right.

What Is the Import Duty Formula?

After gathering your product’s HS code, confirming the country of origin, and determining the correct customs value, you’re ready for the final step. Here’s the formula that customs authorities worldwide rely on:

Import Duty = Customs Value × Tariff Rate (%)

This straightforward equation is the foundation of every import duty calculation. But as you’ll notice, the accuracy of your result depends on getting each component correct. Let’s break down what goes into each part.

Breaking Down the Formula: Each Component Explained

- Customs Value: This is not just your invoice price. It includes the total landed cost of your goods, covering the declared value, shipping, insurance, and any additional costs directly related to getting your goods to the border. Most countries use the CIF (Cost, Insurance, Freight) value as the base for duty assessment.

- Tariff Rate (%): This percentage is determined by your product’s HS code and the country of origin. It could be a standard rate, a preferential rate (if a trade agreement applies), or a higher rate for restricted goods. Always check the latest tariff schedules from official customs resources before shipping.

Imagine you’re importing $12,000 worth of electronics from a country with a 7% tariff rate. Your customs value (including shipping and insurance) is $12,000. Here’s how you’d use the import duty formula:

- Import Duty = $12,000 × 7% = $840

That $840 is what you’ll pay in import duties—before considering other taxes or fees like VAT or customs processing charges.

Why Accuracy in Every Step Matters

Sounds simple, right? But here’s where many importers get tripped up: even a small error in your customs value or HS code can multiply into a much larger problem. For example, under-declaring your customs value might seem like a way to save money—but if discovered, it can lead to fines, shipment delays, or even seizure of goods. Overstating the value, on the other hand, means you pay more duty than required. And if you use the wrong HS code or miss a preferential tariff rate, your costs or compliance risks skyrocket.

- Pro Tip: Always double-check your product classification, valuation, and documentation before submitting your customs declaration. A single oversight can mean paying non-refundable taxes on goods you can’t even sell!

How Inspection and Verification Services Prevent Costly Surprises

Imagine paying thousands in import duties, only to discover your shipment was misclassified, undervalued, or didn’t match your order. Not only do you lose out on the products—you’ve paid irreversible taxes on them. This is where third-party inspection and verification services become a critical safeguard.

- First Article Inspection: Confirms your product matches specifications before mass production begins.

- Production Monitoring: Ensures ongoing batches meet quality and compliance standards.

- Pre-shipment Inspection: Verifies the quantity, quality, and packaging before goods leave the factory.

Services like Eagle Eyes Quality Inspection Services provide on-the-ground checks in manufacturing hubs, ensuring your documentation and product details are accurate before you even ship. This means your HS code, customs value, and supporting paperwork are correct—so your import duty calculation is always defensible and your landed cost is protected.

Putting It All Together: A Checklist for Accurate Import Duty Calculation

- Confirm accurate HS code classification for your product.

- Document the correct country of origin and check for preferential tariff rates.

- Calculate your customs value using the full landed cost (CIF method).

- Apply the correct tariff rate from official customs schedules.

- Use the import duty formula to determine your payable duty.

- Consider professional inspection and verification to avoid costly errors.

By following these steps, you’ll not only master how to calculate customs duty—you’ll also dramatically reduce the risk of unexpected expenses, shipment delays, or compliance headaches. Next, let’s explore the most common mistakes importers make in this process—and how you can sidestep them for smooth, cost-effective international trade.

Common Pitfalls and How to Avoid Errors When Calculating Tariffs

Ever wondered why some importers breeze through customs while others face unexpected costs, shipment holds, or even legal trouble? The answer often lies in a handful of preventable import tariff mistakes. If you want to avoid customs penalties and keep your shipments on track, it’s crucial to recognize—and sidestep—the most common errors made during the process to calculate import tariffs.

Why Do Mistakes Happen?

Sounds complicated? It doesn’t have to be. Most errors occur because importers overlook details, rely on outdated information, or misunderstand how customs rules work. Imagine investing time and money into a shipment, only to see it delayed or penalized because of a simple documentation slip or an incorrect tariff rate. Let’s break down the traps importers fall into and show you how to avoid them.

Top Import Tariff Mistakes and How to Avoid Them

| Common Mistake | How to Avoid It |

|---|---|

| Using Outdated Tariff Rates Importers sometimes rely on old tariff schedules or unofficial sources, leading to under- or overpayment of duties. |

|

| Incorrect Country of Origin (COO) Assuming the country of shipment is the country of origin, or misdeclaring COO to lower duties. |

|

| Under-Declaring Customs Value Reporting a lower value to reduce duty payments—intentionally or by missing required cost components. |

|

| Misclassifying HS Codes Assigning the wrong product code leads to incorrect tariff rates or loss of trade agreement benefits. |

|

| Neglecting Other Taxes and Fees Focusing only on import duty, while missing VAT, excise, or customs processing fees. |

|

| Poor Recordkeeping Failing to maintain complete and accurate documentation for each import transaction. |

|

Actionable Tips to Avoid Customs Penalties

- Stay informed: Subscribe to official customs updates and review regulations before every new product launch or shipment.

- Double-check every detail: From HS code to customs value, even small mistakes can trigger audits or fines.

- Work with experts: When in doubt, consult customs brokers or compliance advisors who can spot errors early.

- Implement internal controls: Use checklists, regular staff training, and internal audits to catch discrepancies before they become problems.

- Be transparent and proactive: If you discover an error, correct it promptly and notify customs if required—voluntary disclosure can reduce penalties.

By learning from these common import tariff mistakes and following the solutions above, you’ll be well-equipped to avoid customs penalties and keep your global supply chain running smoothly. Up next, we’ll summarize the key takeaways and show how mastering these steps can lead to confident, cost-effective international trade.

Conclusion

When you look back at the journey to calculate import tariffs, it’s clear that accuracy at every step is not just a best practice—it’s a necessity. Why? Because every detail, from the HS code to customs value and country of origin, can have a direct impact on your bottom line, your ability to clear customs smoothly, and your global competitiveness. So, what are the most important lessons to take away as you prepare for your next international shipment?

The Essentials: What Sets Successful Importers Apart

- Accurate HS Code Classification: This is the foundation for all duty calculations. A single digit out of place can lead to overpaying, underpaying, or even customs disputes. Always use up-to-date resources and document your classification process.

- Comprehensive Customs Value Calculation: Don’t just rely on the invoice price. Make sure you include all relevant costs—freight, insurance, packing, and commissions—to reflect the true landed value of your goods. This ensures you pay the right amount and avoid penalties or shipment delays.

- Correct Country of Origin Documentation: The right COO can unlock preferential tariff rates or exemptions under trade agreements. Take time to prove and document origin, especially for products with global components or complex supply chains.

Why Mastering Tariff Calculation Empowers Your Business

Imagine the confidence of knowing your import duty calculations are bulletproof. No more last-minute surprises, budget overruns, or compliance headaches. By mastering these steps, you gain:

- Control over landed costs: You can price products accurately, protect profit margins, and make better sourcing decisions.

- Import tariff compliance: Avoid fines, shipment holds, and reputational risks by meeting all legal requirements.

- Confidence in global trade: With a clear process, you can expand to new markets, negotiate better with suppliers, and respond quickly to regulatory changes.

Safeguarding Your Landed Cost with Quality Inspection Services

But even the most diligent importer can face unexpected risks—damaged goods, miscounts, or misclassified shipments. That’s why leading businesses turn to third-party inspection and verification services as a final layer of protection. Services like Eagle Eyes Quality Inspection Services help ensure your declared customs value matches what’s actually shipped, and that your documentation stands up to scrutiny.

- Pre-shipment inspections: Confirm product quality, quantity, and compliance before goods leave the factory.

- Factory audits and container loading supervision: Prevent costly errors that could inflate your landed cost or trigger customs red flags.

- Extensive on-the-ground coverage: Especially valuable when sourcing from regions like China, where supply chains are complex and mistakes can be expensive.

Think of these services as your risk insurance for international trade—they don’t just help you avoid penalties, but also ensure that every dollar spent on tariffs is an investment in sellable, compliant inventory.

“Effective import tariff compliance and landed cost optimization are not just about following rules—they’re about building a resilient, profitable business that can thrive in any global market.”

Ready to take your import operations to the next level? By combining accurate calculations with robust verification practices, you’ll be positioned to trade confidently, minimize surprises, and seize new opportunities worldwide.

Frequently Asked Questions

1. How is the value for import tariffs calculated?

Import tariffs are based on the customs value of your goods, which typically includes the product cost, shipping, insurance, and related fees. This value serves as the base for applying the correct tariff rate, ensuring you pay the right amount and avoid penalties.

2. What information do I need to calculate import tariffs accurately?

You need your product’s HS code, the full customs value (including freight and insurance), the country of origin, and the applicable tariff rate. Each detail affects your final duty, so accuracy is crucial for compliance and cost control.

3. How do HS codes impact my import duty calculation?

HS codes classify your product and determine which tariff rates and trade rules apply. Using the correct code ensures you pay the proper duty and access possible trade agreement benefits, while misclassification can lead to overpayment, penalties, or shipment delays.

4. Why does the country of origin matter for tariffs?

The country of origin determines if your goods qualify for preferential rates or trade agreements, which can lower or eliminate tariffs. It’s not always the country of shipment, so proving the correct origin is essential for accurate duty calculation.

5. How can inspection services help with import tariff compliance?

Inspection services like Eagle Eyes Quality Inspection verify your goods’ quality, quantity, and documentation before shipment. This ensures your customs value is accurate and helps prevent costly mistakes or non-refundable duties on unsellable products.