Ⅰ.The current situation of coal transportation

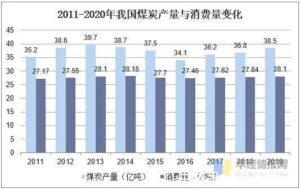

Coal plays an irreplaceable role in China’s energy structure. In 2019, China’s coal output reached 3.85 billion tons, of which domestic consumption reached 2.81 billion tons. At present, coal accounts for 68.8% of China’s energy production structure, while coal consumption accounts for 57.7% of the total energy consumption in the proportion of primary energy consumption. At the present stage, China’s economy has already walked out of the 12-16 years of deep adjustment period, and energy demand has also picked up significantly compared with previous years. China’s current per capita electricity consumption is only one third of that of developed countries, about 3000-4000 kWh. There is still room for China’s power development in the future. In addition to some allocation of new energy for power generation, there is also room for the development of thermal power in terms of peak regulation requirements. China’s oil and gas resources are insufficient, and a large number of imports are affected by the international political and economic situation. At present, oil and gas can only be widely used in transportation and chemical industry, and a large number of imports into the electric power industry is unlikely. After the leapfrog development of the new energy, represented by the renewable energy, the problem of technical bottleneck also begins to appear. Therefore, coal will remain one of the most important domestic energy sources for a long time in the future.

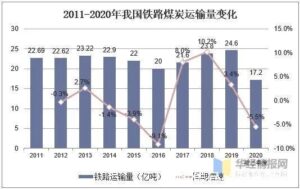

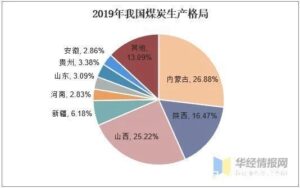

Due to uneven distribution of coal resources in China, mainly for the northern region is greater than the southern area and west area is more than the eastern region, coal production and supply area are mainly in Inner Mongolia, shanxi, shaanxi, xinjiang and other regions, accounting for more than half of the coal production, and the regional distribution of coal consumption, especially in the eastern coastal developed areas, The use and consumption of coal account for the vast majority, so the transport of coal resources is mainly from west to east and from north to south. In the long-distance coal transport process, railway transport accounts for a large proportion, accounting for more than 75% of the coal transport volume, and has been the main mode of coal transport for a long time. Since 2017, China’s coal railway transport volume has gradually recovered, reaching a historical high of 2.46 billion tons in 2019. In 2020, due to the impact of high-speed toll-free policy, many downstream users turn to the automobile transport market after the reduction of automobile transport cost, which has squeezed the railway coal transport volume. The coal transport volume in the first three quarters of 2020 fell back year-on-year.

Ⅱ.China’s coal transport channels

Inner Mongolia, Shaanxi and Shanxi are the three major coal-producing regions in China, accounting for 26.88%, 16.47% and 25.22% of China’s coal output respectively. For a long time, China’s coal transport has formed the following pattern: Shanxi coal and Mongolian coal are mainly sold to North China, East China, Northeast China and coastal areas; Shaanxi coal is mainly sold to East China, Central China, Northwest China, Southwest China and other areas; Xinjiang coal is mainly sold to Northwest China, Sichuan and Chongqing; Guizhou coal is mainly sold to Southwest China. In recent years, the coal transfer volume from Shanxi, Shaanxi and Mongolia has been increasing year by year, taking up a proportion of the total inter-provincial transport volume from 86% in 2016 to 91% in 2019. In recent years, due to the obvious improvement of railway transportation conditions, the coal output of Shaanxi Coal has increased significantly, and it is gradually occupying the market share of Central China and East China, which were originally Shanxi Coal’s sales regions.

In 2019, the water under coal from seven major ports (Qinhuangdao Port, Tangshan Port, Tianjin Port, Huanghua Port, Rizhao Port, Qingdao Port and Lianyungang Port) reached 758 million tons. And the main mode of transportation of these coal is railway transportation, mainly through the Daqin line, Shuohuang line, Mongolian-Hebei line and other lines to the east and south of the transport. For Shanxi Province in north-central in daqin line of coal supply and stake ordos ZhunGeEr mining area (bag) east of the west, the new moon yellow line mainly undertake mining area of shaanxi, date line docking in southern shanxi mining area, the fountainhead and attract new HaoJi line, mainly stake in ordos coal (bag) west of the west and northern shaanxi coal, a key area mainly for hubei hunan-kiangsi region area. However, according to calculation, the outward transport of coal through Haoji Railway is cheaper than the transfer from Mengji-Hebei to Daqin Line to “Haijinjiang”, but it is more expensive than the transfer from Shuohuang Line to “Haijinjiang”. Therefore, the diversion effect of this railway still needs long-term observation.

III.State policies on regulation and control of the coal industry

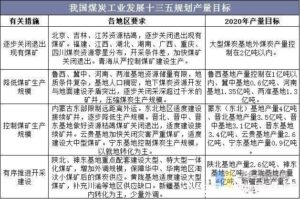

According to the Coal Industry Development “13th Five-Year Plan”, the national coal development layout is to compress the east, limit the central and northeast, optimize the west; Due to the exhaustion of coal resources, complex mining conditions and high production costs in eastern China, the scale of production has been gradually reduced. The development intensity of the existing coal resources in the central and northeast regions is large, and the investment efficiency is reduced. The western region is rich in resources, has good mining conditions and a fragile ecological environment. Efforts should be strengthened to coordinate resource development and ecological environmental protection, and integrated coal mines should be built in combination with the coal needs of coal power generation and coal deep processing projects. In general, due to the further concentration of coal production capacity in Shaanxi, Shaanxi and Inner Mongolia, the unbalanced situation of coal production and sales in China will be more obvious. The demand for coal transportation is expected to increase further in the future.

Ⅳ. The influence of imported coal on coal transportation

Other imported coal for domestic coal transport industry has a certain influence, especially in Australia and Indonesia imported coal is mainly used in the southeast coastal area, south China and southwest, these places are from Australia and Indonesia, ocean freight is low, than from Inner Mongolia, shanxi, shaanxi and other traditional coal-producing provinces of molten iron transport freight cost is low. And Inner Mongolia, Shaanxi and other places also need to transfer to the southeast coastal ports by train and sea, that is, through Daqin, Wari, Longhai and other railways, Qinhuangdao, Rizhao, Huanghua, Tianjin, Lianyungang and other ports on the ship, from sea to the destination, and then transfer to the coal customers. Although China imports about 300 million tons of coal every year, accounting for less than one-tenth of its output, it is equivalent to a coal railway. For price-sensitive industries such as the coal industry, the increase in imports will have a big impact on the domestic coal and coal transport market.