The past few years have seen a boom in the entrepreneurial ecosystem in Southeast Asia. In the Indian market, there are already over 30 unicorns in e-commerce, content, education, insurance, etc. Other Southeast Asian countries have also seen Go-Jek, Grab and other giants in mobility and payments. Behind them are countless entrepreneurs who follow the new economy and the layout of capital to promote.

The overseas investment institutions in the Indian market of South Asia are like snipers, targeting the most promising business models and teams. Familiar investors like SoftBank, Sequoia and Tiger have taken Indian entrepreneurship to a new level with real money. This not only complements entrepreneurs’ enthusiasm for exploration, but also creates a driving effect that attracts entrepreneurs from other Southeast Asian countries to pour into this game of capital and innovation. Vietnam is one of them. According to the 2019 Vietnam Technology Investment Report, in just two years, the number of start-ups in Vietnam’s market has risen to the third place among ASEAN countries, after Singapore and Indonesia.

Market

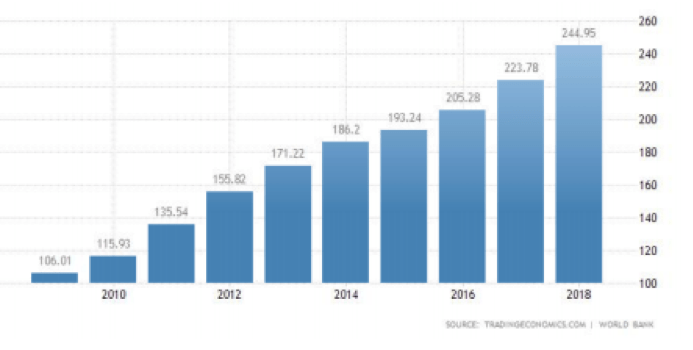

In 2018, Vietnam’s GDP reached US $244.9 billion, with a growth rate of more than 6% for many years in a row. Benefited by changes in the international situation, policy support for development and continuous increase in FDI attracted, Vietnam’s market has become one of the fastest growing countries in the world. It is expected that Vietnam’s economic growth rate will exceed 7% in 2019, surpassing China’s growth rate.

The internal factors of Vietnam’s development cannot be separated from the elevation of Vietnam’s urbanization level and its remarkable demographic dividend. In 2019, Vietnam’s population reached 96.208 million, ranking the third in Southeast Asia. The median age of the population was 26.9 years. By comparison, the median age of China’s population is 37. A large pool of young workers has provided ample fuel for economic growth. Benefiting from Vietnam’s more abundant labor force and lower production costs, a large number of enterprises have opened plans to enter Vietnam. The layout of the giants led to a domino effect, further enhancing Vietnam’s reputation as an overseas base, creating a virtuous circle. Samsung’s presence in Vietnam has also encouraged other South Korean companies to enter the country. A few years later, not only was Samsung the largest foreign investor in Vietnam, but other small and medium-sized Korean companies, such as service companies and corporate law firms, entered the Vietnamese market and set up offices in Hanoi and Ho Chi Minh. The layout of large companies is a positive experiment which, if successful, will encourage more multinational manufacturing enterprises to move to Vietnam.

Preferred Southeast Asia

According to research by Topica Founder Institute, the total amount of funding received by Vietnamese start-ups in 2018 was $889 million, a 300% increase from the previous year. There are already more than 3,000 start-ups in Vietnam, covering a wide range of sectors. Policy encouragement, economic development, rapid popularization of the Internet and other factors are pushing Vietnam’s entrepreneurial ecology to a new climax. Policy. The Vietnamese government has set up policies at the national or municipal level to support entrepreneurial development, such as providing low-interest loans, scientific and technological support, and business planning guidance.

In 2017, Deputy Prime Minister Vuong Dinh Hue announced the development goal of increasing the number of businesses in Vietnam from 500,000 to 1 million by 2020. Silicon Valley Vietnam is a government-sponsored initiative to provide legal and financial support to 2,600 start-ups over the next 10 years. At the same time, the government has relaxed a visa program for Vietnamese nationals, allowing them to regain citizenship under certain conditions, and reduced restrictions on foreign investors. In turn, technology accelerators are driving the growth of start-ups.

The development of the entrepreneurial ecology in Vietnam

According to research by Topica Founder Institute, the total amount of funding received by Vietnamese start-ups in 2018 was $889 million, a 300% increase from the previous year. There are already more than 3,000 start-ups in Vietnam, covering a wide range of sectors. Policy encouragement, economic development, rapid popularization of the Internet and other factors are pushing Vietnam’s entrepreneurial ecology to a new climax. Policy. The Vietnamese government has set up policies at the national or municipal level to support entrepreneurial development, such as providing low-interest loans, scientific and technological support, and business planning guidance.

In 2017, Deputy Prime Minister Vuong Dinh Hue announced the development goal of increasing the number of businesses in Vietnam from 500,000 to 1 million by 2020. Silicon Valley Vietnam is a government-sponsored initiative to provide legal and financial support to 2,600 start-ups over the next 10 years. At the same time, the government has relaxed a visa program for Vietnamese nationals, allowing them to regain citizenship under certain conditions, and reduced restrictions on foreign investors. In turn, technology accelerators are driving the growth of start-ups

Challenge

In addition to driving economic growth, start-ups represent a profound transformation of Economy 4.0, which is transmitted to various economic, social and other fields. Behind the boom, however, was hard work. According to Viet Tonkin, a Vietnamese agency, there are more than 3,000 start-up projects in Vietnam. The success rate is less than 3%, and 80% of the startups in the market fail within two years.

The reason behind this is its fierce competitive environment. Vietnam’s Internet ecology developed late, and local startups were faced with fierce competition at the very beginning. Among them, Alibaba, Tencent, Toutiao and other Chinese Internet giants went overseas to set up shop. And the expanding global footprint of Indian start-ups such as Oyo, a hotel chain.

In addition, there are also Southeast Asian countries such as Indonesia, Singapore and other unicorns going to the sea, taking advantage of their first-mover advantage in the market and the support gained in the capital market to quickly take root and sprout in the Vietnamese market. It can be said that this is both opportunities, advantages and challenges: on the one hand, from the very beginning, it has provided Vietnamese companies with an international perspective, and the mature business model has quickly lifted Vietnam’s Internet ecology to a higher level; From the perspective of adverse factors, when local startups grow to a certain scale, they will directly face the competitive pressure brought by international giants, which makes small startups with insufficient resources and experience struggle for survival.

The capital market

It has been more than 15 years since the early capital investment institutions entered Vietnam. IDG has had an office in Vietnam since 2004 and has invested in VNG, the country’s largest game publisher. In addition to American investment institutions looking for opportunities in the Vietnamese market, there are also Japanese VCs. CyberAgent Ventures (CAV), a Japanese VC, entered the Vietnam market back in 2008. Investment case of Tiki, Foody and other head projects.

Interestingly, while investors from Silicon Valley and Singapore have long played a prominent role, South Korea outperformed other countries in 2018, taking part in 30% of investment projects and becoming the most active investor in Vietnam’s startup market. It can be seen that startup investment in Vietnam was initially dominated by international capital, and it has achieved good returns. Although there are also old-school Vietnamese institutions such as Vinacapital and VIG in the market, in recent years, with the deepening development of the entrepreneurial ecosystem, the performance of local Vietnamese VC has become more active. Of the 92 investment and financing deals in 2017, foreign capital invested in 28, while domestic VC invested in 64. Through the amount of investment, we can see that local VC investment is increasing and playing a more important role, which is a big positive. However, these local institutions still face the situation of insufficient capital at home, and the increasing market competition and the big players’ competition for opportunities in Vietnam also make the local VC appear to be “born at an inappropriate time”.

The growing competitive pressures in Vietnam can be seen in another way: the giants have diversified. This shows that they have gained sufficient advantages in their respective fields and intend to expand their advantages in other adjacent fields. Tiki has gradually expanded from book e-commerce to full-category retail, and is now developing cross-border e-commerce. The same is to sell books to start, the outcome is very different from Dangdang. The constant infiltration of giants has brought the reality of increased competition for startups. Competition is no longer the PK of the original era of cold weapons, but evolved into the scale of the head companies, took the weapons of capital, to enjoy their success in the field of segmentation.

Seek new opportunities in Vietnam

Vietnam’s economic growth is evident. Pan Song, chairman of Quequo Capital, visited Vietnam more than a decade ago and was left with an impression of dirt, mess and poor infrastructure, but this year he has made several trips to the country to scout out investment opportunities in India and Southeast Asia. “I definitely feel different. I’m making more progress than I thought.” Having worked overseas for more than 20 years, he personally invested in the Indian market in recent years and made good achievements in the investment of start-up projects. “We want to learn from China’s successful business model and use our strengths in other regions to invest in promising industries.” Indeed, there are many precedents for the success of the Chinese model in Vietnam. Millennium Dragon, the Vietnamese version of Focus Media, has been located in many office buildings in Ho Chi Minh and Hanoi. The company was founded in 2006, which happened to be the time point when Focus Media went public and elevator media model was confirmed. Chequo Capital is also looking for opportunities to bring this high-frequency and precision marketing model to other regions, such as the South Asian subcontinent and India, in the form of capital.

Vietnam is in a golden stage of rapid development. The Southeast Asian country, with its abundant labor force, rapidly developing Internet ecosystem, and changing external factors, has also allowed Vietnam to undertake more industrial transfers and share increasing dividends in international trade. Can Vietnam repeat China’s rapid growth since the beginning of the new century? Where will the next unicorn come from? What will Vietnam look like in the next 10 years? The unknown is young people enjoying afternoon tea at Aha Coffee, cars passing by Grab on the street, and Zalo messages popping up on young people’s phones. In its own unique way, Vietnam is embracing change, making this seemingly traditional country stand at the crossroads of new economic transformation. In the game of entrepreneurship there is always failure and there is always success. Yes, Vietnam is no exception.